Newsletter Subscribe

Enter your email address below and subscribe to our lovely newsletter.

*We do not spam & you can unsubscribe at any time.

Enter your email address below and subscribe to our lovely newsletter.

*We do not spam & you can unsubscribe at any time.

*This post may contain affiliate links. If so, we may earn a small commission when you make a purchase through links on the site. This is at no additional cost to you. Read full disclosures here

Healthcare in the Philippines operates as a tiered system, marked by significant disparities. Affluent residents and wealthy expatriates residing in urban centres have access to high-quality healthcare services, including private hospitals and foreign-trained medical professionals.

In contrast, those in rural and economically disadvantaged areas often face limited access to adequate healthcare, experiencing healthcare issues and receiving considerably lower levels of medical care and treatment.

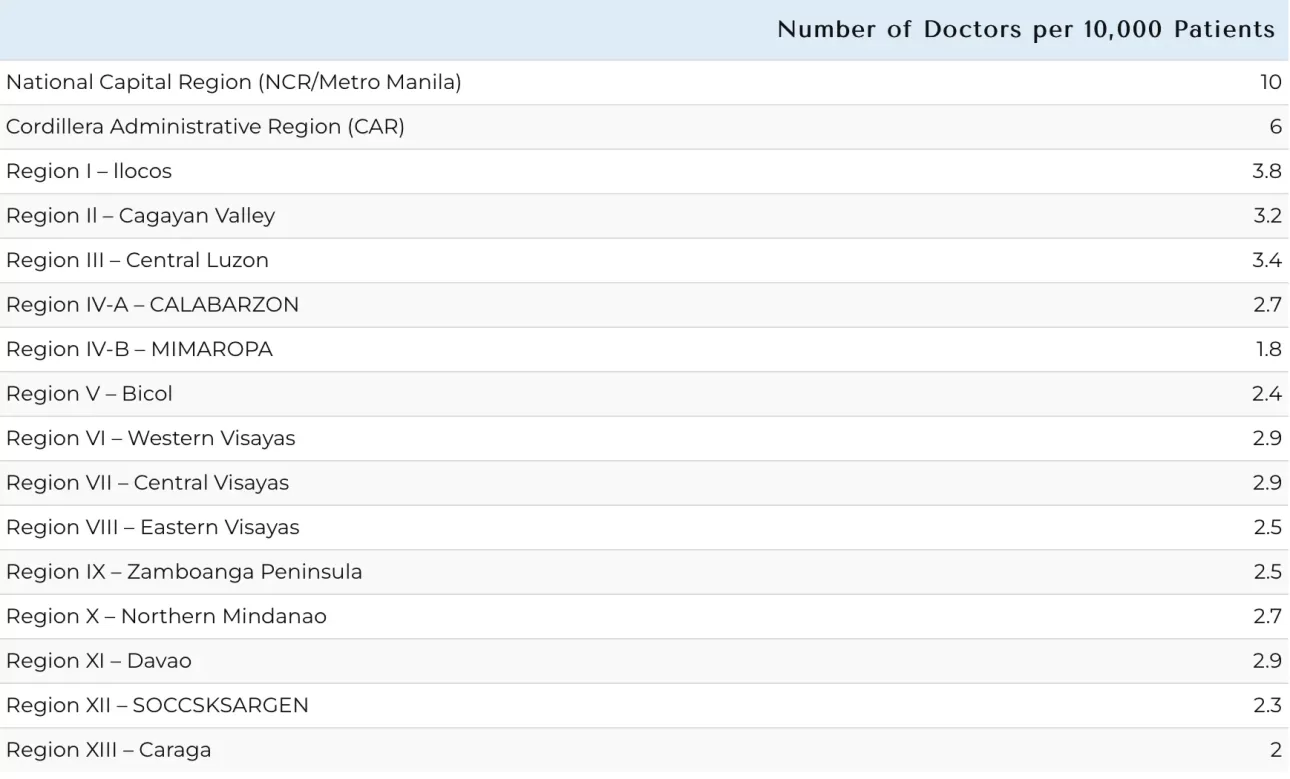

If you are an expat with medical conditions, you will want to live in a major city for property medical care. Only NCR (National Capital Region- Metro Manila) meets the WHO minimum of 10 doctors per 10,000 residents.

Although the Philippines may not have a long-established reputation as a hub for medical expertise, it boasts a solid foundation in Western medicine thanks to its historical connections with the United States. Healthcare costs in the Philippines are generally lower than in Western countries, especially for elective procedures.

The country is recognised as a promising medical tourism destination, currently holding the 24th position out of 46 countries on the 2020 Medical Tourism Index. The availability of English-speaking doctors and nursing staff and the competitive pricing of medical services contribute to this.

According to Numbeo’s 2023 Mid-Year Global Healthcare Index, the Philippines ranks at #40, while the US ranks slightly higher at #36. This index evaluates various aspects of a country’s healthcare system, including waiting times, skill level, modern equipment, and cost.

In 2019, new legislation reshaped the future of PhilHealth. Then President Rodrigo Duterte signed the Universal Healthcare Bill, also known as the “UHB,” into law. Public healthcare now extends to 100% of the country’s citizens in the PhilHealth system. Previously, only those employed were covered, while informal workers and the unemployed had limited coverage.

With the signing of the UHC Act (RA11223), all Filipinos are already automatically included under the National Health Insurance Program (NHIP) – making PhilHealth’s coverage rate at 100%.

PhilHealth

Chasing convenience? Enter online doctor consultations in the Philippines, available 24/7 for a mere $8 a year. Out of necessity, medical tech proliferated in response to the pandemic’s need for remote healthcare.

Post-pandemic, remote health has been a godsend for those living away from the city or unable to make in-person visits. You get the same level of expert advice and prescriptions sans the waiting time or risk of infections from hospital visits.

Data from recent medical studies show that 70% of patients using telemedicine in the Philippines say the effectiveness is equal to or better than seeing a doctor face-to-face.

[Telemedicine is] just so much more efficient and convenient, and I feel like the doctors are not in a rush to get to the next patient, and they really try to [serve] you better over telehealth as compared to face-to-face consultations.

Filipina, 20–24 years old)

There’s a strong chance you’ve met a Filipino healthcare professional in your home country. A sizable percentage of the country’s medical workforce studied and underwent their medical training abroad, primarily in the US, UK, and Canada.

The Philippines is a well-known supplier of healthcare professionals worldwide. Filipino doctors and nurses are known for their exceptional skills, compassionate care, and strong work ethic. In fact, the International Labour Organization has recognized the Philippines as one of the world’s top sources of medical professionals.

What does it mean for you? You can expect high-quality healthcare services from well-trained and experienced professionals at a fraction of the cost you would pay in most developed countries. Plus, with English being widely spoken in the Philippines, communication between patients and healthcare providers is usually not an issue.

But there’s a downside – the healthcare system is bearing the brunt of the resulting “brain drain.

Despite many different policy efforts to reduce the flow, in recent years still, an average of 13,000 nurses migrate very year

Netherlands Enterprise Agency

Known as “drugstores” locally, they’re widespread and can provide many over-the-counter and prescription medications. But keep in mind that not all pharmacies are created equal. Some have better product selections, while others may not carry certain medications.

Look for reputable chains such as Mercury Drug and Watsons, or ask locals for their preferred pharmacy recommendations. Many pharmacies also have licensed pharmacists who can assist with minor health issues and provide over-the-counter medication.

Additionally, it’s worth noting that pharmacies in the Philippines usually have a separate section for generic medications, which are significantly cheaper than branded ones. Don’t hesitate to ask the pharmacist if they have a generic alternative for your prescribed medication.

However, keep on a look out for prices that are too good to be true. The Philippines proximity counterfeit drug manufacturers in China and India means that there is an issue with knockoff drugs.

460 pharmaceutical crime incidents took place within Southeast Asia from 2013 to 2017 …Out of these 460 incidents, 193 of which occurred in the Philippines, 110 in Thailand, 93 in Indonesia, and 49 in Vietnam.

United Nations Office on Drugs and Crime (UNODC)

Let’s talk numbers. My cost of private health insurance in the Philippines with $5,000,000 in coverage is ₱61,000 per year.

However, your cost depends on several factors: age, provider, coverage area, and coverage period.

Cigna Global

Ideal For- Older expats with health concerns or chronic conditions.

IMG- International Medical Group

Ideal For- Younger expats looking for affordable overseas coverage with optional benefits.

William Russell International Health Insurance Plan

Ideal For- Perfect for expats who need customised care and don’t visit the United States

Pacific Cross

Ideal For- Most long term expats in the Philippines. As a local HMO they will settle bills directly with hospitals in the Philippines.

As an American veteran residing in the Philippines, you’re in luck. The only VA hospital outside of the United States is in Manila, Philippines. As a perk of your honorable service, the VA covers qualified healthcare services to eligible service members at the VA Hospital in Manila. From in-patient hospital care to rehabilitation to mental health services, it’s covered if the eligibility criteria are met.

You can get free VA health care for any illness or injury that we determine is connected to your military service (called a “service-connected disability”). You may also be eligible for more free VA health care based on factors like your disability rating, service history, or income.

Veterans Affairs

Expats can avail of three main types of medical insurance coverage in the Philippines: PhilHealth, HMO (Health Maintenance Organization), and Health Insurance. Here’s a quick look at these options to better understand what they offer and how they differ.

PhilHealth– PhilHealth is the primary health insurance program in the Philippines, providing coverage for both Filipinos and foreigners residing in the country. PhilHealth’s primary purpose is financial assistance and coverage for necessary medical procedures. It’s also the most affordable option, with monthly contributions starting at around Php 400 (approximately $7.50).

HMO– HMOs are private health insurance companies that provide exclusive healthcare coverage to their members. These services usually include inpatient and outpatient medical coverage, emergency care, laboratory procedures, and specialist consultations. Additionally, this insurance type gives you access to a wide network of doctors and healthcare providers nationwide.

Private employers often provide HMOs as part of their benefits package to their employees in addition to their PhilHealth coverage. But, if your employer doesn’t offer such benefits or you’re a self-employed expat, you can still get an HMO membership individually.

The coverage limit depends on the premium paid and the plan selected. The average annual premium is Php 20,000 (approximately $350 USD). Most HMOs in the Philippines are affiliated with private hospitals, making it an attractive option for those who prefer specialised treatment.

International Health Insurance– Health insurance may be the best choice for foreigners who prefer more comprehensive coverage. Unlike PhilHealth and HMOs, this option provides higher coverage limits and other benefits, like maternity care, mental health services, and cancer care. It also gives access to a wider network of hospitals, medical providers, and specialists worldwide.

Premiums for health insurance are much higher than PhilHealth and HMOs, with costs varying depending on the coverage limit, deductibles, and type of plan selected.

Expats in the Philippines commonly choose international insurance because it offers comprehensive benefits, excellent customer service, and flexibility, especially if they need to relocate or receive medical treatment in another country.

This isn’t Colombia or Mexico, where you can walk in off the street and get access to nearly any drug you need without a doctor’s note. In the Philippines, drug regulation is a serious business. Don’t think about heading to a pharmacy for prescription drugs without a written script from a doctor.

And remember, it should clearly specify the generic name of the drug, not just the brand. The authorities strictly observe these guidelines, ensuring pharmacies uphold the rules for safe and legal distribution.

Getting additional coverage does come with a cost, but compared to American expats used to the sky-high medical costs in the US, it’s quite laughably low. And the benefits go beyond just affordability.

Private insurance lets you enjoy preferential treatment at modern private hospitals. That means shorter appointment waiting times, private rooms during hospital stays, and access to top-notch health standards. Plus, the doctors at these private facilities are bilingual and have excellent education, many of whom have graduated from prestigious medical schools or completed part of their training abroad.

There’s a 911 line in the Philippines to call the national ambulance service. However, emergency services may not be available in all areas of the country, and sometimes no one answers the call.

The lack of strict enforcement of the public emergency system results in inadequate first-aid treatment and delayed response times. Private ambulances, many of which are affiliated with private hospitals, offer faster response times, highly trained medical personnel, and advanced medical equipment.

It is important for expats to have access to contact information for private ambulance services and their nearest hospital in case of emergencies.

Another good number to know is for the Philippine Red Cross : 143

Sorry, United States citizens. Time for a reality check: your Medicare won’t cover healthcare services in the Philippines with very few exceptions. International travel and living abroad are usually not included in the scheme. Hence, consider purchasing private health insurance or enrolling in PhilHealth, the local insurance. Your health deserves the best! So plan accordingly to save yourself from any future financial and health hassles.

Medicare usually doesn’t cover health care while you’re traveling outside the U.S.

Medicare.gov

The term “outside the U.S.” means anywhere other than the 50 states of the U.S., the District of Columbia, Puerto Rico, the U.S. Virgin Islands, Guam, American Samoa, and the Northern Mariana Islands.

While it is illegal for public hospitals to detain you for non-payment, private hospitals or even private rooms in public hospitals are a different story. You need to settle your hospital bills before private hospitals in the Philippines give the green light to leave.

If you don’t pay in full. Don’t expect an easy exit; you might face detention at the hospital until your debt is cleared. So, manage your finances wisely or have a robust health insurance in place to avoid sticky situations.

While the public healthcare system in the Philippines covers primary medical care, it doesn’t provide coverage for vision and dental procedures.

When considering private health insurance or HMO as an individual member, it’s worth noting that vision coverage is typically not included. On the other hand, dental care is often offered as an optional add-on, which may come with an additional cost.

However, some employers may provide vision and dental care as additional benefits for their foreign employees on expat compensation packages.

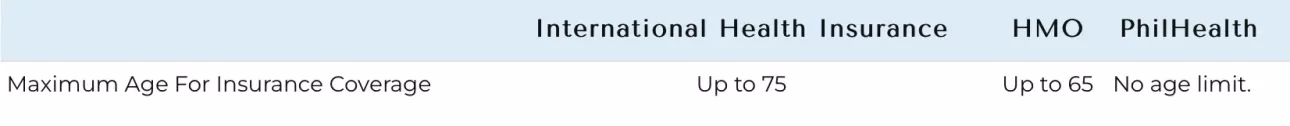

One challenge that older expats may face regarding healthcare coverage in the Philippines is age restrictions. While PhilHealth has no age limit, some HMOs and health insurance providers may have a cut-off age for enrollment. For example, the maximum enrollment age limit for HMOs is typically up to age 60 and renewable up to age 65.

However, health insurance premiums significantly increase for older expats as they age or due to the higher risk of pre-existing conditions at an advanced age.

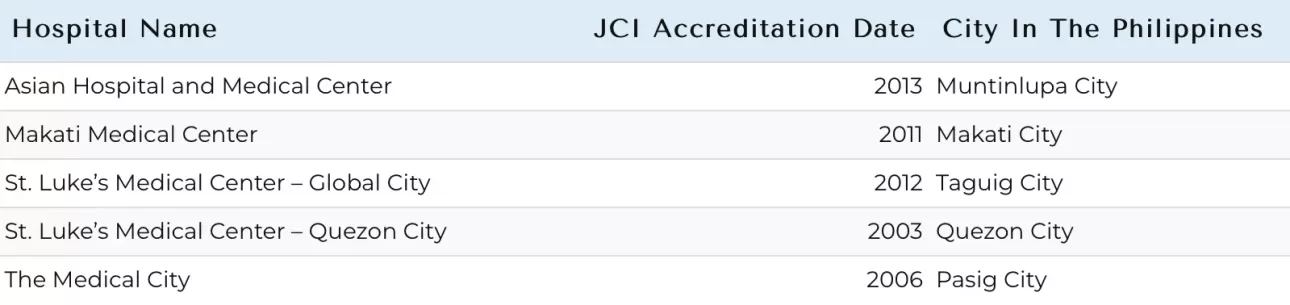

Joint Commission International, a global organization that assesses healthcare quality and patient safety, has recognized and accredited five health care providers in the Philippines for their exceptional standards. These hospitals are among the best in the world, ensuring top-notch healthcare services for patients.

Looking to save money on a major treatment or surgery? Ask if your doctor also has a public hospital contract. Many doctors in the Philippines practice in both public and private hospitals. You could get the same quality surgeon in a public hospital for a fraction of the cost. It might not have the frills of a private setup, but the potential savings make it an option worth considering.

While the Philippines is known for its high-quality and affordable healthcare systems, it is worth noting that it is still undergoing changes. The government has been implementing reforms to improve access to healthcare for all citizens, including expats. This is true with the passing of the Universal Health Bill in 2019.

Not everything about the healthcare system is improving, however. Due to several factors, including the rising cost of delivering health care, poor infrastructure, and allegations of corruption in the government, the system has taken a hit in recent years. This was highlighted during the onset of COVID-19 when the Philippines had one of the longest lockdowns in the world.

The mismanagement of public hospitals, especially in rural areas, is also a significant concern. It’s common for these hospitals to have inadequate facilities and medical supplies. Moreover, the public healthcare system in the Philippines faces several challenges, which include:

Limited resources – Limited medical staff, outdated medical facilities, inadequate medical supplies, and insufficient healthcare infrastructure, especially in remote communities.

Long Wait Times – While wait times are typical in larger hospitals, they’re more prevalent in public hospitals due to the high service demand. The urgency of a patient’s condition determines the duration of the wait, which can range from hours to days before receiving medical attention or undergoing procedures.

Poor Infrastructure – In certain rural areas, public healthcare facilities lack fundamental amenities like clean water, electricity, and proper sanitation. This exposes individuals to the risk of infection and disease transmission and hampers the provision of adequate medical services.

Eligible expatriates can enter the public healthcare system by purchasing PhilHealth coverage. PhilHealth insurance grants access to government-managed healthcare services, covering many standard treatments at an affordable rate. However, keep in mind that PhilHealth does not cover every procedure, and treatments in rural regions can be lacking.

PhilHealth annual costs for expats is:

Keep in mind that your domestic medical insurance is unlikely to extend coverage to the Philippines. While travel insurance may offer limited emergency coverage, comprehensive coverage requires an international or local health insurance policy.

Most likely no. Most health insurance will not cover you for any injuries sustained outside your home country. To get protection while living abroad, there are two options:

It’s not uncommon in the Philippines to be asked for cash upfront before receiving medical care. If you find yourself in an accident and can’t communicate, the hospital may delay treatment until you can get credit card pre-approval or a family member provides payment details.

However, upfront payment is not a universal rule. Be prepared and inquire about the payment process when seeking medical care in the Philippines. Even if you are insured, prepare to pay out-of-pocket first before getting any reimbursement from your insurer. A tip: Have an emergency fund ready for such emergencies.

When you find yourself in a Philippine hospital, it might seem unusual, but having a friend, family member, or helper stay with you at the hospital is “normal”. Unlike a US hospital, nurses and hospital staff typically won’t provide personal care.

You will need a spouse or “hospital companion” to assist with various tasks like obtaining prescriptions, purchasing personal supplies (toilet paper, toothpaste, etc.), or bringing you food.

Safeguard your health. Carry a mosquito net and topical repellents wherever you go. Wear protective clothing to minimise exposure when venturing outdoors.

Healthcare in the Philippines will be just as good, if not better, than in other developing countries. It’s relatively inexpensive, and the country boasts highly skilled medical professionals.

However, the Philippine healthcare system is under strain from staffing shortages, infrastructure neglect, and lack of investment that need to be addressed. As an expat, conducting thorough research and planning for any potential healthcare needs during your stay in the Philippines is crucial.

I recommend purchasing private expat health insurance with robust medical evacuation and repatriation coverage.

Save up to 60% using this link

Encrypt your data when online +

Start enjoying UK T.V. from abroad, including:

BBC iPlayer, ITV Hub, Netflix (UK) (USA) and more.