Healthcare in the Philippines is a tiered system

Healthcare in the Philippines is a tiered system with significant differences between urban and rural areas. In major cities, affluent residents and expatriates have access to high-quality healthcare in the Philippines, including modern private hospitals, advanced medical facilities, and foreign-trained doctors.

In contrast, rural and low-income communities often face limited access to healthcare services, with fewer medical professionals and restricted treatment options. This creates a noticeable gap in the overall Philippines healthcare system.

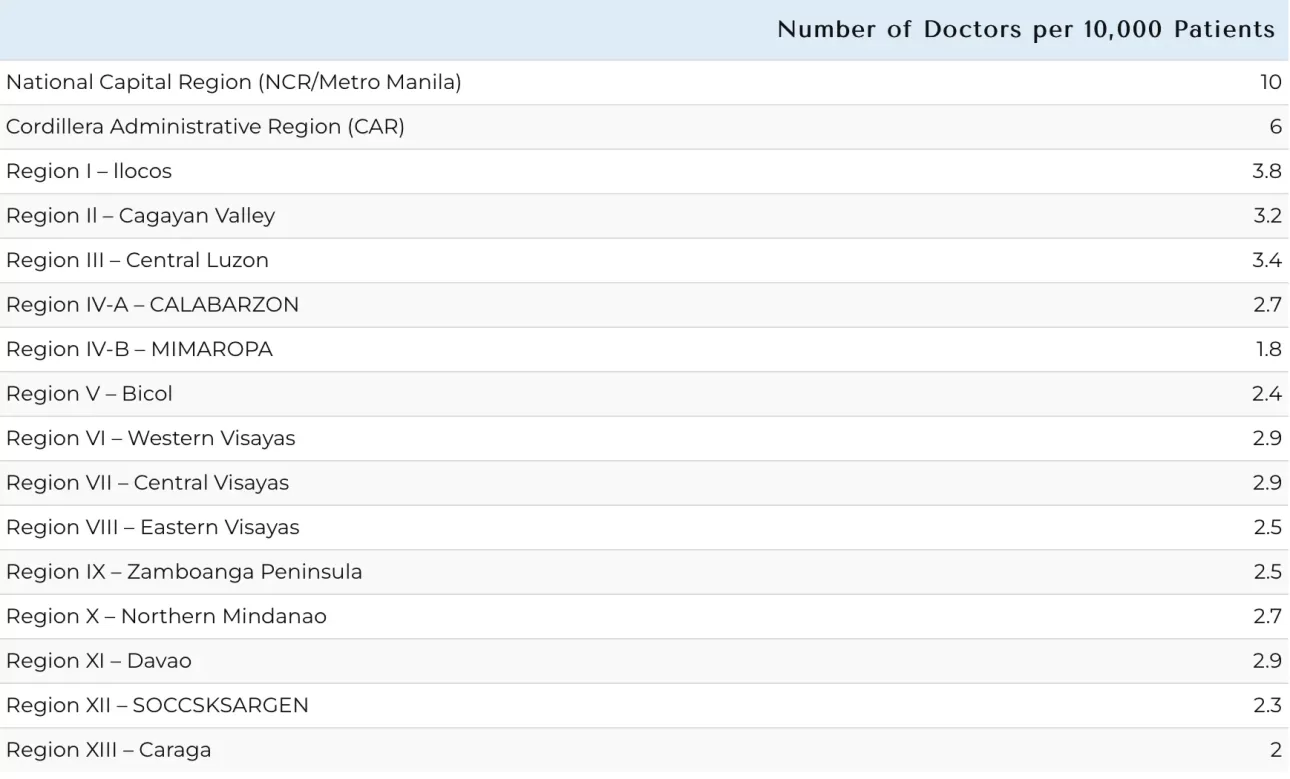

For expatriates, especially those with ongoing medical conditions, living in a major city is strongly recommended. At present, only the National Capital Region (Metro Manila) meets the World Health Organization’s minimum standard of 10 doctors per 10,000 residents, making it the most reliable location for comprehensive expat healthcare in the Philippines.

The healthcare quality in the Philippines is considered to be of a high standard

While the Philippines may not yet be globally known as a hub of medical expertise, it has a strong foundation in Western-style healthcare due to its long-standing ties with the United States. One of its biggest advantages is cost: healthcare in the Philippines is generally far more affordable than in Western countries, particularly when it comes to elective procedures and medical treatments.

The country is steadily gaining recognition as a medical tourism destination, ranking 24th out of 46 countries in the 2020 Medical Tourism Index. Affordable pricing, the availability of English-speaking doctors and nurses, and modern facilities make it especially attractive for foreign patients seeking quality care at lower costs.

According to Numbeo’s 2023 Mid-Year Global Healthcare Index, the Philippines healthcare system holds the 40th spot worldwide, while the United States ranks slightly higher at #36. This index considers factors such as waiting times, doctor skill levels, access to modern medical equipment, and overall healthcare affordability.

The Philippines has a universal healthcare system

In 2019, the future of PhilHealth changed significantly with the signing of the Universal Healthcare Bill (UHC) into law by then-President Rodrigo Duterte. Under this landmark reform, PhilHealth coverage was expanded to include 100% of Filipino citizens. Before this, the system mainly covered those in formal employment, leaving informal workers and the unemployed with only limited access to public healthcare.

With the signing of the UHC Act (RA11223), all Filipinos are already automatically included under the National Health Insurance Program (NHIP) – making PhilHealth’s coverage rate at 100%.

PhilHealth

The Philippines has online 24/7 Doctor Consultations available for $8 a year

Chasing convenience? Enter online doctor consultations in the Philippines, available 24/7 for a mere $8 a year. Out of necessity, medical tech proliferated in response to the pandemic’s need for remote healthcare.

Post-pandemic, remote health has been a godsend for those living away from the city or unable to make in-person visits. You get the same level of expert advice and prescriptions sans the waiting time or risk of infections from hospital visits.

Data from recent medical studies show that 70% of patients using telemedicine in the Philippines say the effectiveness is equal to or better than seeing a doctor face-to-face.

[Telemedicine is] just so much more efficient and convenient, and I feel like the doctors are not in a rush to get to the next patient, and they really try to [serve] you better over telehealth as compared to face-to-face consultations.

Filipina, 20–24 years old)

A large percentage of Filipino doctors studied, trained, and work abroad

Chances are you’ve already met a Filipino healthcare professional in your home country. Many doctors and nurses from the Philippines complete part of their training abroad—particularly in the US, UK, and Canada—before returning to practice or working internationally.

The Philippines is one of the world’s leading suppliers of healthcare professionals, with Filipino doctors and nurses highly regarded for their clinical skills, compassionate care, and strong work ethic. The International Labour Organization has even recognized the country as a top global source of medical professionals.

For expatriates and medical tourists, this translates into access to high-quality healthcare in the Philippines at a fraction of the cost compared to Western countries. And since English is widely spoken by healthcare providers, communication is straightforward, reducing stress during medical consultations or treatment.

But there’s a downside – the healthcare system is bearing the brunt of the resulting “brain drain.

Despite many different policy efforts to reduce the flow, in recent years still, an average of 13,000 nurses migrate very year

Netherlands Enterprise Agency

Pharmacies in the Philippines can be your first stop for minor health issues

In the Philippines, pharmacies—commonly called drugstores—are easy to find and offer a wide range of both over-the-counter and prescription medications. However, not all pharmacies provide the same level of service or product availability. Some carry a more complete selection, while others may lack certain medicines.

For reliability, stick to well-known pharmacy chains such as Mercury Drug and Watsons, or ask locals for trusted recommendations. Most reputable pharmacies in the Philippines also have licensed pharmacists who can advise on minor health concerns and recommend suitable over-the-counter treatments.

A key advantage is the availability of generic medicines, which are significantly more affordable than branded options. Always ask if a generic equivalent is available for your prescription to save on costs.

That said, exercise caution: the Philippines’ proximity to large counterfeit drug markets in China and India has led to occasional issues with fake or substandard medicines. Avoid unusually cheap offers and always purchase from established, trusted pharmacies.

460 pharmaceutical crime incidents took place within Southeast Asia from 2013 to 2017 …Out of these 460 incidents, 193 of which occurred in the Philippines, 110 in Thailand, 93 in Indonesia, and 49 in Vietnam.

United Nations Office on Drugs and Crime (UNODC)

The price for private health insurance can be as low as $100

Let’s talk numbers. My cost of private health insurance in the Philippines with $5,000,000 in coverage is ₱61,000 per year.

However, your cost depends on several factors: age, provider, coverage area, and coverage period.

My Top 4 Recommendations For Expat Insurance In The Philippines

Cigna Global

Ideal For- Older expats with health concerns or chronic conditions.

IMG- International Medical Group

Ideal For- Younger expats looking for affordable overseas coverage with optional benefits.

William Russell International Health Insurance Plan

Ideal For- Perfect for expats who need customised care and don’t visit the United States

Pacific Cross

Ideal For- Most long term expats in the Philippines. As a local HMO they will settle bills directly with hospitals in the Philippines.

US Veterans can get free healthcare at a VA Hospital in the Philippines

If you’re an American veteran living in the Philippines, you have a unique advantage: the only VA hospital outside the United States is located in Manila. This facility provides eligible U.S. veterans with access to a wide range of healthcare services, all covered under VA benefits.

Qualified veterans can receive in-patient hospital care, rehabilitation programs, outpatient services, and mental health support at the VA Manila Outpatient Clinic. As long as you meet the eligibility requirements, your honorable service ensures you continue receiving the medical care you’ve earned—even while living abroad in the Philippines.

You can get free VA health care for any illness or injury that we determine is connected to your military service (called a “service-connected disability”). You may also be eligible for more free VA health care based on factors like your disability rating, service history, or income.

Veterans Affairs

There are 3 types of medical insurance in the Philippines

If you’re an expat living in the Philippines, you’ll find three main types of medical insurance coverage: PhilHealth, HMOs (Health Maintenance Organizations), and International Health Insurance. Understanding these options will help you choose the right plan based on your needs, lifestyle, and budget.

1. PhilHealth (Public Health Insurance)

PhilHealth is the government’s national health insurance program, available to both Filipinos and foreign residents in the Philippines. Its main purpose is to provide financial support for essential medical procedures and hospitalizations.

- Most affordable option – monthly contributions start at around ₱400 (USD $7.50)

- Covers necessary medical procedures, hospitalization, and some treatments

- Ideal as a basic safety net, but coverage is limited compared to private plans

2. HMOs (Private Health Maintenance Organizations)

HMOs are private insurance providers that offer exclusive medical coverage to members. Plans typically include:

- Inpatient and outpatient care

- Emergency treatment

- Laboratory tests and diagnostics

- Access to a nationwide network of doctors and private hospitals

Many employers in the Philippines provide HMO coverage alongside PhilHealth. For self-employed expats or those without employer-provided benefits, individual HMO plans are available.

- Average annual premium: around ₱20,000 (USD $350)

- Coverage depends on the plan and premium paid

- Preferred by expats who want reliable access to private hospitals and specialists

3. International Health Insurance

For expats seeking the most comprehensive health insurance in the Philippines, international medical insurance is the top choice. These plans provide:

- Higher coverage limits and global protection

- Specialized benefits such as maternity care, cancer treatment, and mental health services

- Access to both local hospitals and international healthcare providers

While significantly more expensive than PhilHealth or HMOs, international health insurance is popular among expats because of its flexibility, customer service, and worldwide coverage—especially for those who may relocate or need treatment abroad.

✅ Tip for Expats: Many foreigners combine PhilHealth + an HMO or International Plan to balance affordability with comprehensive protection.

Many pharmacies will need a prescription for most drugs

This isn’t Colombia or Mexico, where you can walk in off the street and get access to nearly any drug you need without a doctor’s note. In the Philippines, drug regulation is a serious business. Don’t think about heading to a pharmacy for prescription drugs without a written script from a doctor.

And remember, it should clearly specify the generic name of the drug, not just the brand. The authorities strictly observe these guidelines, ensuring pharmacies uphold the rules for safe and legal distribution.

The Philippines’s private health insurance system is more affordable for foreign expats

Getting additional coverage does come with a cost, but compared to American expats used to the sky-high medical costs in the US, it’s quite laughably low. And the benefits go beyond just affordability.

Private insurance lets you enjoy preferential treatment at modern private hospitals. That means shorter appointment waiting times, private rooms during hospital stays, and access to top-notch health standards. Plus, the doctors at these private facilities are bilingual and have excellent education, many of whom have graduated from prestigious medical schools or completed part of their training abroad.

Don’t Call 911 For Emergency Medical Services in the Philippines

There’s a 911 line in the Philippines to call the national ambulance service. However, emergency services may not be available in all areas of the country, and sometimes no one answers the call.

The lack of strict enforcement of the public emergency system results in inadequate first-aid treatment and delayed response times. Private ambulances, many of which are affiliated with private hospitals, offer faster response times, highly trained medical personnel, and advanced medical equipment.

It is important for expats to have access to contact information for private ambulance services and their nearest hospital in case of emergencies.

Another good number to know is for the Philippine Red Cross : 143

Medicare is not accepted in the Philippines

Sorry, United States citizens. Time for a reality check: your Medicare won’t cover healthcare services in the Philippines with very few exceptions. International travel and living abroad are usually not included in the scheme. Hence, consider purchasing private health insurance or enrolling in PhilHealth, the local insurance. Your health deserves the best! So plan accordingly to save yourself from any future financial and health hassles.

Medicare usually doesn’t cover health care while you’re traveling outside the U.S.

Medicare.gov

The term “outside the U.S.” means anywhere other than the 50 states of the U.S., the District of Columbia, Puerto Rico, the U.S. Virgin Islands, Guam, American Samoa, and the Northern Mariana Islands.

You may be detained in a private hospital for unpaid medical bills

While it is illegal for public hospitals to detain you for non-payment, private hospitals or even private rooms in public hospitals are a different story. You need to settle your hospital bills before private hospitals in the Philippines give the green light to leave.

If you don’t pay in full. Don’t expect an easy exit; you might face detention at the hospital until your debt is cleared. So, manage your finances wisely or have a robust health insurance in place to avoid sticky situations.

Vision and dental coverage aren’t covered in public health services

While the public healthcare system in the Philippines covers primary medical care, it doesn’t provide coverage for vision and dental procedures.

When considering private health insurance or HMO as an individual member, it’s worth noting that vision coverage is typically not included. On the other hand, dental care is often offered as an optional add-on, which may come with an additional cost.

However, some employers may provide vision and dental care as additional benefits for their foreign employees on expat compensation packages.

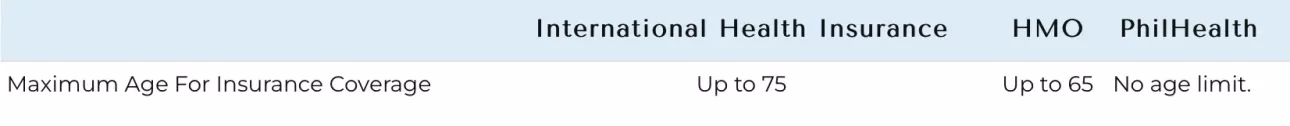

Retired expats find it harder to get healthcare coverage

One challenge that older expats may face regarding healthcare coverage in the Philippines is age restrictions. While PhilHealth has no age limit, some HMOs and health insurance providers may have a cut-off age for enrollment. For example, the maximum enrollment age limit for HMOs is typically up to age 60 and renewable up to age 65.

However, health insurance premiums significantly increase for older expats as they age or due to the higher risk of pre-existing conditions at an advanced age.

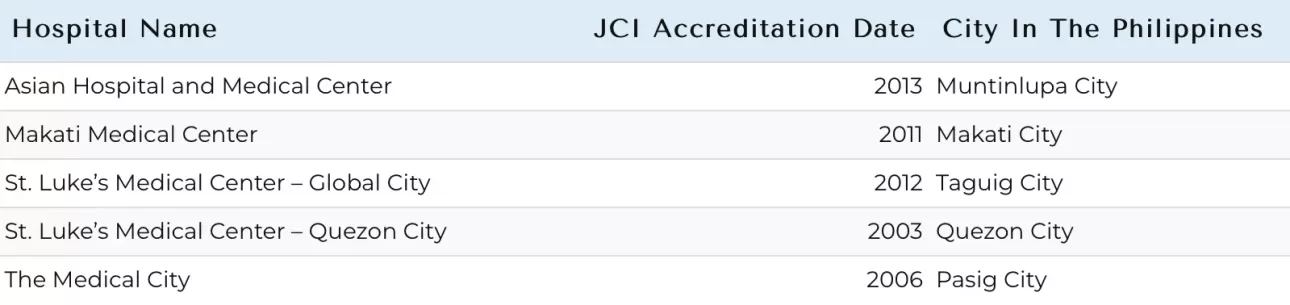

Five Hospitals in the Philippines meet best international standards for healthcare

Joint Commission International, a global organization that assesses healthcare quality and patient safety, has recognized and accredited five health care providers in the Philippines for their exceptional standards. These hospitals are among the best in the world, ensuring top-notch healthcare services for patients.

You can save money by asking if your doctor also has a public hospital contract

Looking to save money on a major treatment or surgery? Ask if your doctor also has a public hospital contract. Many doctors in the Philippines practice in both public and private hospitals. You could get the same quality surgeon in a public hospital for a fraction of the cost. It might not have the frills of a private setup, but the potential savings make it an option worth considering.

The healthcare system in the Philippines is somewhat draconian

While the Philippines is known for its high-quality and affordable healthcare systems, it is worth noting that it is still undergoing changes. The government has been implementing reforms to improve access to healthcare for all citizens, including expats. This is true with the passing of the Universal Health Bill in 2019.

Not everything about the healthcare system is improving, however. Due to several factors, including the rising cost of delivering health care, poor infrastructure, and allegations of corruption in the government, the system has taken a hit in recent years. This was highlighted during the onset of COVID-19 when the Philippines had one of the longest lockdowns in the world.

The mismanagement of public hospitals, especially in rural areas, is also a significant concern. It’s common for these hospitals to have inadequate facilities and medical supplies. Moreover, the public healthcare system in the Philippines faces several challenges, which include:

Limited resources – Limited medical staff, outdated medical facilities, inadequate medical supplies, and insufficient healthcare infrastructure, especially in remote communities.

Long Wait Times – While wait times are typical in larger hospitals, they’re more prevalent in public hospitals due to the high service demand. The urgency of a patient’s condition determines the duration of the wait, which can range from hours to days before receiving medical attention or undergoing procedures.

Poor Infrastructure – In certain rural areas, public healthcare facilities lack fundamental amenities like clean water, electricity, and proper sanitation. This exposes individuals to the risk of infection and disease transmission and hampers the provision of adequate medical services.

Foreigners are eligible for public healthcare with a PhilHealth Policy

Eligible expatriates can enter the public healthcare system by purchasing PhilHealth coverage. PhilHealth insurance grants access to government-managed healthcare services, covering many standard treatments at an affordable rate. However, keep in mind that PhilHealth does not cover every procedure, and treatments in rural regions can be lacking.

PhilHealth annual costs for expats is:

- Foreign Retirees with a SRRV Visa– $300 / 15,000 PHP per year

- Foreign Nationals with an ACR-I-Card- $335 / 17,000 PHP per year

Your home country medical insurance will not cover you in the Philippines

Keep in mind that your domestic medical insurance is unlikely to extend coverage to the Philippines. While travel insurance may offer limited emergency coverage, comprehensive coverage requires an international or local health insurance policy.

Will My Home Country Health Insurance Cover Me?

Most likely no. Most health insurance will not cover you for any injuries sustained outside your home country. To get protection while living abroad, there are two options:

- Travel Health Insurance: This will cover you for unexpected medical issues while overseas. However, the coverage requires you to maintain insurance in the United States or your respective home country. I pay roughly $50 per month for complete coverage with no deductible.

- Expat Medical Insurance: If you retire abroad, expat health insurance is a more complete option. Expat Medical Insurance is the “normal” insurance you are familiar with from home. Coverage is built for people who live in a country versus traveling. While more expensive than Travel Medical Insurance, premiums are still cheaper than in the US.

You may be asked for cash upfront before getting medical care in the Philippines

It’s not uncommon in the Philippines to be asked for cash upfront before receiving medical care. If you find yourself in an accident and can’t communicate, the hospital may delay treatment until you can get credit card pre-approval or a family member provides payment details.

However, upfront payment is not a universal rule. Be prepared and inquire about the payment process when seeking medical care in the Philippines. Even if you are insured, prepare to pay out-of-pocket first before getting any reimbursement from your insurer. A tip: Have an emergency fund ready for such emergencies.

You might need a friend or helper to stay at the hospital with you

When you find yourself in a Philippine hospital, it might seem unusual, but having a friend, family member, or helper stay with you at the hospital is “normal”. Unlike a US hospital, nurses and hospital staff typically won’t provide personal care.

You will need a spouse or “hospital companion” to assist with various tasks like obtaining prescriptions, purchasing personal supplies (toilet paper, toothpaste, etc.), or bringing you food.

Dengue Fever and Malaria are health hazards

Safeguard your health. Carry a mosquito net and topical repellents wherever you go. Wear protective clothing to minimise exposure when venturing outdoors.

Summary : Healthcare System in the Philippines

Healthcare in the Philippines will be just as good, if not better, than in other developing countries. It’s relatively inexpensive, and the country boasts highly skilled medical professionals.

However, the Philippine healthcare system is under strain from staffing shortages, infrastructure neglect, and lack of investment that need to be addressed. As an expat, conducting thorough research and planning for any potential healthcare needs during your stay in the Philippines is crucial.

I recommend purchasing private expat health insurance with robust medical evacuation and repatriation coverage.

Leave a Reply