Why would you move abroad?

What are the things that make you want to pack your bags and start a new life abroad?

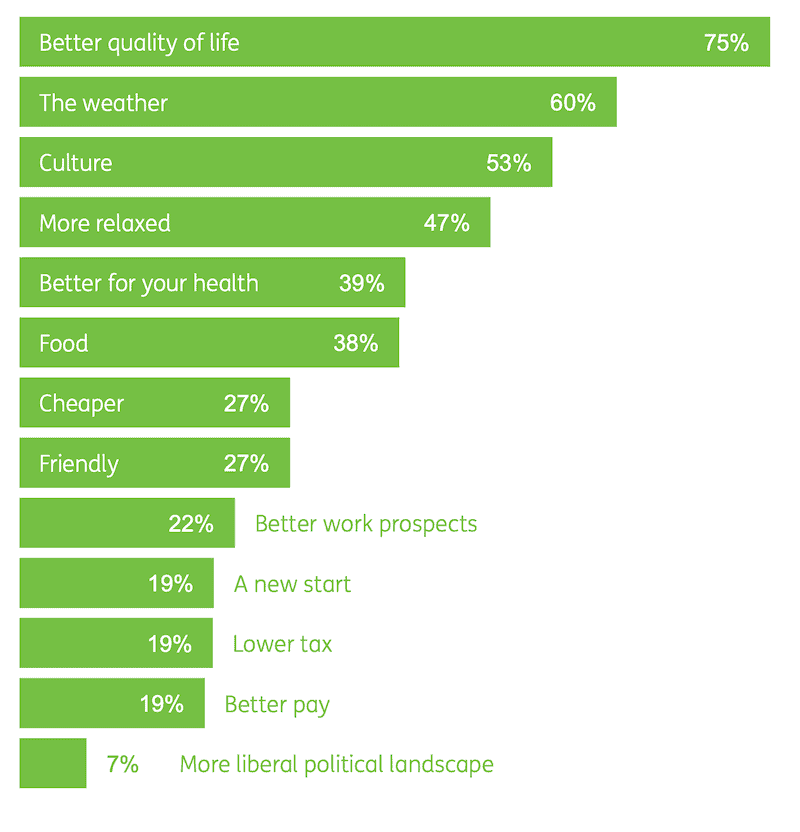

In a recent survey of over a thousand would-be expats, three quarters of those polled said a better quality of life attracted them to a move overseas.

Fed up of Britain’s changeable weather and unpredictable summers, 60% are enticed by better weather. 53% are attracted to the culture, and a more relaxed way of life appeals to 47%. It seems that many of us are stressed out by life in the UK, and the idea of somewhere to redress the work/life/commute balance is pretty alluring.

27% think it would be cheaper to live abroad, while 38% say it’s the healthier living that appeals. 38% also point to the food as being a big pull. It’s not exactly difficult to see why; cool, refreshing gazpacho and a paella loaded with fresh seafood, rice and spices? Or a Cacciucco (Tuscan seafood stew) accompanied by a Bolgheri Bianco?… lovely stuff.

What’s attractive about a move abroad?

Unsurprisingly, when asked what would stop them from heading overseas, 73% answered ‘friends and family’.

A third (33%) said they’d miss the culture in the UK, 31% say healthcare is better at home and 16% said they’d miss the superior quality of life they enjoy at home.

But for one in five, it’s simply the idea of a new start that attracts then to a move abroad. If you’re looking for a new start yourself, I hope you find the following information useful as a starting point for your overseas adventure.

A Sense of Self

There are many benefits of living abroad, from immersing yourself in a new culture to developing a clearer sense of self. Personally, moving abroad enabled me to appreciate different cultures whilst slowing down and enjoy my life more.

But before you pack everything up and leave your country, it is critical that you do a bit of research and self-reflection.

Recommended Reading:

Developing a clearer sense of self

Checklist

If you’re moving away for a new life abroad, or thinking about doing so, there’s a lot to think about. I’ve thought of the most important things you need to consider, and in this guide, I’ll be covering the following topics:

- Picking the right country

- Finding a home and buying it

- Getting your currency transfers right

- Taxes

- Money and banking

- Getting a job

- Schools and education

- Healthcare

- Voting when you’re living overseas

- Security

Picking the right country

First thing’s first. Choosing where to live is probably the most important consideration of all. Starting life in a new land is a costly, time-consuming exercise and, realistically, you’ve got one chance to get it right.

You may already have somewhere in mind; maybe you’ve always loved the idea of living in a particular country? If that’s the case, make sure the reality lives up to the ideal. And if you’re starting from scratch and all you know is that you want to get away somewhere, bear in mind the following:

In the year to August 2020, 403,000 people left the UK.

Source: ONS : View Source

Choose the place that will meet your needs. It should give you everything, or nearly everything, you need. It may be your dream location, but if finding a school there for your children is a nightmare, it’s not going to work.

Decide on your priorities – the things you must have. It may be tolerance of a religion or sexual orientation, values that mirror your own, low crime, good schools or a national health system.

Recommended Reading:

Popuar Retirement Destinations – The Truth Exposed

Do your research – scour magazines and books, join online forums, ask lots of questions (and see what issues keep recurring). Then go there, spend a good amount of time there, and decide whether it is the place for you.

Preparing to relocate

Moving house is daunting enough, but factor-in moving to another country and it can seem overwhelming. However, with a little thought you can make the transition much more straightforward. Here are are few things to consider:

Property

If you own your own home the first thing you need to think about is whether to:

- Retain your property and rent it out

- Sell your property and make fresh start

- Downsize

You will read everywhere online about selling-up and moving abroad. More often than not these articles peddle affiliate links to international removal companies that pay websites referral commissions. I would strongly recommend that you consider my alternatives as follows:

1. Rent out your existing property

There are a plethora of reasons why retaining a foothold in your country of domicile (where you were born) is a wise move.

- If you happen upon homesickness, poor health or financial impositions and wish to return ‘home‘ you will have a place to return to.

- Whilst you are living in another country the value of property in your home country could skyrocket. Having no ‘skin in the game‘ will mean you have missed out on that capital appreciation and may not be able to afford to repurchase a similar property again, without digging deep.

- Rental income can provide additional spending power, especially if the rent you receive exceeds the rent you are paying in your new country – profit!

- You should use an established rental agent (not a trusted friend!) to manage your property for peace of mind. They can handle disputes, damage and payment issues in your absence.

- You can always sell your property later – should you need to do so for tax purposes. If your life in your new country of residence is working out, you may need to show you have made a ‘clean break’ by not retaining assets in your home country.

2. Sell your property

You may have your own reasons for wishing to sell you existing property prior to moving to another country and becoming an expat.

- You have already found your dream home abroad (or hope to) and need the money to buy it.

- For tax purposes you need to show you have made a ‘clean break’ and it is not your intention to return to your country of domicile.

- If you retain your property it would be one less thing to worry about.

- Your property is somewhat unique and would be hard to rent out successfully.

3. Downsize

Surprisingly, this option is overlooked by the majority and it shouldn’t be. Unless you need to make a ‘clean break’ for tax purposes it can be a very prudent move indeed.

- Downsizing will release capital for a property purchase abroad.

- A smaller property should be easier to rent out and maintain.

- The exercise of downsizing will force you to get rid of all your junk!

By downsizing you will release capital for the purchase of a property abroad, yet retain a foothold in your home country. This makes a lot of sense if you can afford to do it. You have the peace of mind of knowing you have a place to return to if things don’t work out. You will also keep some ‘skin in the game‘ by retaining exposure to the property market in your home country, and you can generate rental income.

Super tips!

Finding a home and buying it

Once you’ve chosen what country you’re going to live in – and the region you’d like to move to – it’s time to choose the house itself.

At the beginning of your house search, looking for homes online is the right way to see what you can get for your money, and to get an idea of where you might like to settle down. But NEVER buy a house without looking at it in person or you could get there and find you’ve been sold a house that doesn’t live up to the pictures in an area you end up hating. So, line up a load of viewings in a variety of different areas of your preferred area, and spend a good few weeks getting to know the place you’ll soon call home.

Find out what local schools, shops and healthcare provisions are available. Does it feel safe, are the people friendly, is it too quiet/ noisy? Having identified your needs right at the beginning, decide whether they will be met here.

The UK has the 8th highest expat rate in the world – 7% of British people live overseas.

Look into renting or buying at least a year before you plan to move. Put your home on the market, or if you’re renting, give notice when you plan to leave. When buying in your new country, choose an estate agent with a good reputation, and ask them upfront what fees you’ll have to pay. Make sure you know your budget, so you won’t waste time with properties you can’t afford.

When you know what house you want, get a qualified lawyer on the case – preferably one that specialises in the land laws of that particular country. The process of buying the property will vary depending on where you’re buying. See the links below for a list of English speaking lawyers.

Useful Links

Getting your currency transfers right

Ten minutes can be a long time in currency markets, let alone ten years.

Ten years ago, nobody had heard of a credit crunch and sovereign risk was when you got into a fight with a man wearing a couple of large gold rings. To those buying a house abroad or looking to emigrate permanently, however, the movements of sterling on the currency markets have always been important.

Looking over the past ten years of the pound’s performance against the euro and the US dollar, we can see just how good some buying opportunities were. I was in the office on New Year’s Eve in 2008 when sterling was close to parity with the euro (one pound worth one euro) following a 19% fall in the last quarter of the year.

A couple of weeks after that GBPUSD (pound versus US dollar) touched 1.35, the lowest since 1985. Both represented collapses in the value of sterling of around between 30 and 40% over the previous year. For Brits looking to buy abroad, that place in the sun rapidly became a ditch in the dark.

Since then however, the picture has improved and the skies have lightened for the pound. While we are not yet back to those pre-Global Financial Crisis levels, for those looking to emigrate the news is a lot cheerier. This graph shows how much rates can change over time.

These fluctuations in the pound just go to show how the amount you end up paying for your new home abroad could change from one month, week or even day to the next. That’s why it may be a good idea to consider fixing an exchange rate in advance, so you’ll know what you pay – and you’ll be unaffected if rates move against you in the meantime.

I recommend using Wise (formerly TransferWise) for International Money transfers. I have used them for many years. They are fast and offer much better Fex rates than high street banks!

Recommended Reading:

Best International Money Transfer Services

Taxes

What you pay in tax will vary from place to place, and the rules may be slightly different.

Here are a couple of examples:

In France, rather than being taxed individually, you’ll be taxed as a family unit. Of course, the ‘family’ of a single childless person is just one person, and they’ll obviously pay a different amount than a family of five. The amount you’ll pay there will be about 40% if you’re self- employed, otherwise it’ll be between 20 and 25%.

In the US, there are six income tax brackets, which range from 10% to 39.6%, and different tax rules for each state and local government.

Low tax rates may appear deceptively low, but you must remember that you’ll need to take out private health insurance in the absence of a national health service.

That’s just a flavour of the variation in taxation rules, and it’s worth getting expert advice to help you understand them better.

Britain has a double taxation agreement with some countries, which means you won’t pay tax on the same income in both countries. Check whether this will apply for you.

Useful gov.uk links (click)

- Living or working abroad or offshore

- Tax on your UK income if you live abroad

- Tax if you leave the UK to live abroad

Money and Banking

Look for a bank with a strong presence in your new country of residence, so you know help is never far away. And always shop around; look out for transaction fees and extra charges for things like paper statements.

Recommended Reading:

How to access your online banking from abroad!

Apply for a bank account in your new country of residence three months before you jet off, so it’s set up when you get there. You’ll need it pretty much straightaway, so your wages can be paid, so you can make mortgage or rent payments and as a guarantee of payment for other services.

It might be worthwhile keeping your home bank account running, especially if you’ve got any ongoing financial commitments in the UK, e.g. a mortgage, bills to pay, or a child at university. If the account’s free anyway, and you’re planning to come home one day, you might as well keep it open.

If you receive a pension income, you can pay it into an international bank account. Just let HMRC National Insurance Contributions Office know, as well as the Department for Work and Pensions.

If you’re on a company or personal pension, these can be transferred to schemes known as QROPS (qualifying recognised overseas pension schemes), though the annual charges on these tend to be higher than for UK pensions. See below for links to some useful information on this.

Recommended Reading:

Definitive Retirement Income Guide

Useful gov.uk links (click)

Getting a job

Unless you’re moving abroad to retire, you’ll need a job when you get there. Without one, you might not even be granted access in the first place.

For example, immigration authorities in Canada won’t accept applications from people who haven’t already arranged their employment, and similarly, the US won’t issue visas to those without a job to go to.

Before you decide on where to go, be sure that your lack of work experience in that country won’t get in the way of you getting a job. Also be clear that your qualifications are recognised in that country. If it’s a non-English speaking country, make sure you meet any language requirements. Once you’re sure of these things, you can apply for a visa, which you should complete before you relocate.

Some visas can take up to two years to get sorted, so get onto this as soon as you know where you’re going. Find out how many other members of your family will need a visa.

Many aspiring expats underestimate how challenging it is to find a job abroad. In some countries your application may end up at the bottom of the pile due to a “residents-first” hiring policy. Not all companies are comfortable offering a position to someone still living in another country. And things like resume vs. CV formatting, cover letter language, and other business culture norms may keep you from landing an interview or position.

One great resource for getting your questions answered is Facebook. There are Facebook expat groups for pretty much every country, and group members can help you with anything from what to wear to an interview to companies with a history of sponsoring work visas.

Another way to relocate is via company transfer. If your company has international offices, talk to your manager and HR reps about your interest in transferring. Be sure to sell the benefits of how your transfer will benefit the company and not just your own personal reasons for wanting to move.

Reaching out to a recruiter consultant for your industry can also be invaluable. If you work in a desirable field like tech or consulting, a recruiter can help connect you with employers in your target countries. Recruiters are usually paid a finder’s fee by the employer, so their services should come at no cost to you.

Additional resources for finding work abroad

- Search for country specific jobs via indeed.com

- 15 Careers that let you travel

- 9 Tips that could help you get a job abroad

- Location Independence archives (The Sweetest Way)

Schools and education

Though leaving home can be hard for your kids, it can turn out to be a very positive experience them.

Expat children are known to be more self- assured and more open minded, and known to grow into articulate, savvy adults. So don’t use your children as an excuse not to go.

Still, you’ll want to be sure that the standard of education your child receives is good enough – there will be more options in larger town than somewhere rural. While most state schools are free, the charges for international schools can be pretty high.

When you’ve decided on a school, you’ll have to complete the paperwork – birth certificate, passport, visa, references, proof of vaccinations from their previous school(s) etc.

Useful links (click)

Healthcare

In the research survey, one of the main reasons why people would be put off moving abroad was that they feel the healthcare provision wouldn’t be as good as at home (32%).

When you live abroad you are no longer entitled to free healthcare via the National Health Service, as the NHS is a residence based health care system. You’ll also be required to contact your own GP before you leave so that they can take you off the register while you’re away.

When it comes to healthcare, there are wide ranging differences from one country to the next, and the services you’re accustomed to in the UK are often not included.

Many countries expect you to make contributions or to join a national healthcare scheme of some kind. You’ll probably have to register with the local authorities in the country and once you’ve set that up and are paying National Insurance contributions it’s quite likely that you’ll be entitled to healthcare in the same way that the citizens of that country are.

Useful gov.uk links (click)

Voting

Just because you’ve decided to live or work in a new country, you’ll still be able to exercise your right to vote in UK elections, as long as you remain a British citizen, for up to 15 years after you’ve left the country.

You will still be eligible to vote in parliamentary and European elections, either by post or by proxy, or even in person if you happen to be visiting home on the right day.

According to the Electoral Commission, only 15,849 of the estimated 5.5 million Britons overseas were registered to vote in UK elections

(March 2014)

It’s fairly straightforward to register to vote from overseas, and you can do so by visiting the About My Vote website.

Security – General

The personal safety basics when moving abroad are not much different to the ones we live by at home.

Common sense stuff like being familiar with the routes you travel, being aware of the people around you, sticking to well-lit roads, we’re already used to adhering to. If you’ve done your research, you’ll reduce your chance of having any problems. Be aware of any local crime issues that may affect you.

Latin America has just 9% of the world’s population but has over 25% of the world’s homicides and about 60% of kidnappings.

(2014 Global Agenda for Economic Freedom)

Depending on where you’re going, you may wish/need to familiarise yourself with the evacuation plan because of things like terrorism, political unrest and natural disasters.

Security – Online

Although online security is of global concern, many countries lack awareness of how sophisticated online fishing, scams and cyber attacks have become. Similarly, local networks can be highly insecure, ATMs can be fake, WiFi networks hacked and vendors can have ‘skimming devices’ to copy your credit card details.

Highly advised further reading: