Newsletter Subscribe

Enter your email address below and subscribe to our lovely newsletter.

*We do not spam & you can unsubscribe at any time.

Enter your email address below and subscribe to our lovely newsletter.

*We do not spam & you can unsubscribe at any time.

*This post may contain affiliate links. If so, we may earn a small commission when you make a purchase through links on the site. This is at no additional cost to you. Read full disclosures here

The vast majority of people become expats because they seek a better quality of life. Moving to another country can provide a better climate, earnings potential and new cultural and social exposure. In some countries the cost of living will be far less than what you have been accustomed to and in others, the cost of living is considerably higher.

Living beyond their means is the single most common mistake made by people who have recently moved abroad and started living in another country.

During the first few months it is tempting to go out as often as possible to explore the surroundings and meet new people. If you have moved to a country with a pleasant climate and/or beautiful surroundings then Why not? This may have been the whole reason you moved, right? If you are active then sightseeing, shopping in big malls and enjoying some luxuries may become an integral part of your everyday life.

However, eating out regularly, socialising with fellow expats, engaging in new leisure activities and exploring your neighbourhood and further afield costs money. There are two types of expats in general – those with lots of money and those who pretend they have lots of money. Yes! expat communities are often very fake, fickle, pretentious and narcissistic.

When you start living in another country as an expat you should not make the mistake of “keeping up with the Joneses”. Be strict with your predetermined budget (yes you should have made one – if not – do it now!) and know when to stop spending.

Just because others (established friends, colleges, or other expats) seem to be spending more, going out more and leading very active, busy lifestyles doesn’t mean you should too. A lot of these people are living beyond their means, amassing debts and ‘faking it’.

In my nearly 20 years of being an expat, trust me when I say that I have met some extremely wealthy expats. As is commonplace around the world, such wealthy individuals do not hog the limelight, talk about their wealth or show off. They all, without exception lead sensible, comfortable lifestyles and have a small close-knit circle of friends.

Don’t allow any insecure feelings of “being left out” fuel over-expenditure. You have nothing to prove to anyone. Your ultimate success as an expat living in another country will be this:

Not running out of money!

Many expats do. Don’t be one of them.

All travellers abroad – especially expats, should be aware of how to protect themselves from the increasing threats posed by electronic and online security fraud. This is covered in full here:

Recommended reading:

Ultimate Guide to card & online security

This situation is frequently overlooked by would-be expats. It is often difficult to know what the best options are when you move abroad. If it is possible for you to retain your current bank account (say, in the U.K.) then keep it. Many U.K. expats simply change their address with their bank to that of a close family member or trusted friend. As all major banks in the U.K. offer paperless, online statement only options (which they encourage for security and also because it saves the bank a massive amount of money in paper, ink, postage and logistics) this is a great option and highly advised.

It is worth noting that a bit of flexible thinking is required here. If you change your correspondence address with your bank whilst you are still in the U.K. and have sold your house and/or moved from your usual address and provide an alternative U.K. correspondence address then fine – you have the right to do so. However, the pressures of the U.K. banking system post the COVID pandemic has caused U.K. banks to reevaluate costs. Expats who have moved abroad to an EU country and provided an EU address are now seeing their U.K. bank accounts under threat of closure. It was likely that this was eventually going to happen anyway after BREXIT, and the COVID pandemic has simply accelerated this process.

If your U.K. bank account has a U.K. correspondence address you will remain unaffected by these changes. This is very much a case of those being “too honest” by providing an E.U. address upon moving abroad getting penalised. Of course this only applies to those who have moved abroad to a country that’s part of the EU.

If you have moved to a country outside of the EU (or plan on doing so) then you have the following options:

* Many countries will allow expats to open accounts locally, but limited to savings accounts without the flexibility of full current account banking facilities.

Once you have settled in your host country, whether as an employee or as a retiree and start receiving income, you may be subject to income tax. Make sure to inquire about the tax system of your host country, especially on the tax rates and conditions that apply.

Many countries have what’s know as a “double taxation agreement” with other countries. This essentially means that if you have already been taxed in one country, then you won’t be taxed again in the other country.

Expats often forget to inform the tax authorities in their home country about their departure (HMRC in the U.K.). It is not advisable to leave such matters pending. If in doubt, pick up the phone and speak to HMRC who are used to such enquiries and can provide you with very helpful guidance. Alternatively, seek the advices of an experienced tax advisor familiar with the law(s) of both your home and destination countries.

In some countries the UK Basic State Pension is indexed linked and in others it’s “frozen” from the date you start to receive it? e.g. If you move to Thailand it’s frozen but in the Philippines it’s indexed linked?

Checkout the current situation for the treatment of your U.K. Basic State Pension in your host country HERE.

How is the performance of your host country’s public healthcare system?

In several countries expats can join the local healthcare system and the cost of doing so varies greatly. There is a wide disparity between cost, standard of care and coverage from country to country. Furthermore, preexisting medical conditions may be excluded.

Are you covered by the local healthcare system at all? What conditions apply? What about your dependents? You need to be able to answer these questions and consider whether or not additional Private Health Insurance is necessary.

Private Health Insurance is expensive, especially so if you have dependents. It requires a significant commitment both financially and morally. And for retirees, oftentimes health insurance starts off affordable but quickly becomes hugely unaffordable in old age.

Your savings might help in case you need urgent care abroad or a treatment that is not included in your health insurance plan (if you have one), so you should always have a ‘slush fund’ for emergencies and the unforeseen.

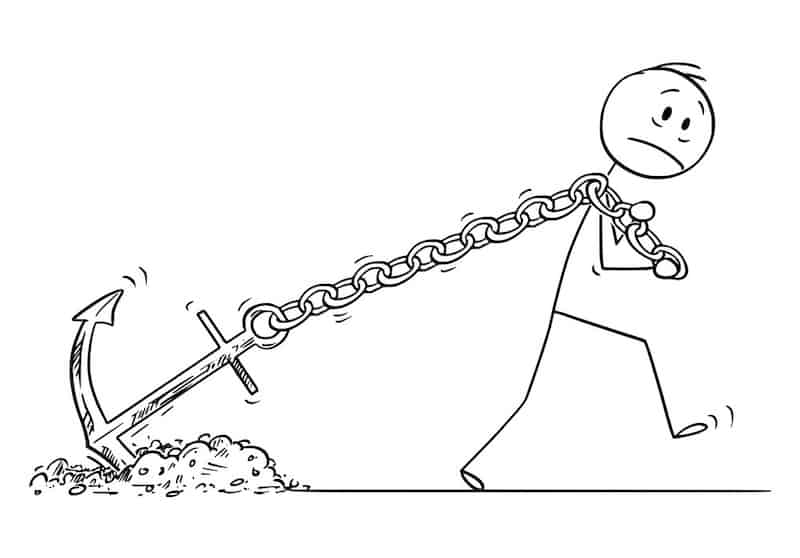

Buying property overseas prematurely is a big mistake. Until you have lived in a country for at least one year, forget it! You should spend your time with your feet on the ground, and your head in reality – not in the clouds. Never, ever buy a property with your heart. Emotional purchases more often than not are the wrong purchases.

Buying property overseas prematurely is a big mistake. Until you have lived in a country for at least one year, forget it! You should spend your time with your feet on the ground, and your head in reality – not in the clouds. Never, ever buy a property with your heart. Emotional purchases more often than not are the wrong purchases.

Currency Exchange Rates: These can work to your advantage or disadvantage.

Global Factors: Political and Economic circumstances will also effect whether you should buy property or not. The COVID pandemic proves that things can change dramatically for better or worse.

Source of wealth: If you income is paid in local currency and you are buying or renting, then this is of little importance. However, for larger purchases like buying property that require you to effectively ‘import’ money from abroad, then at the time of transfer – that’s it! You might be lucky that currency conversion benefits you (it’s all about timing, right?) but of course that’s not always the case.

Resale Value: Unless you are a developer or speculator you don’t set out to buy a property only to sell it again quickly. However, what you think your property is worth and what you may actually be able to sell it for are two different things. A property is only worth as much as someone is prepared to pay for it. Until the money is ‘in the bank’ keep dreaming!

A case in point is Thailand. For many a lovely place to retire, where you used to get 100THB to GBP (in the good old days) and historically around 70THB to GBP. However at the time of writing the exchange rate is 40THB to GBP. Yes! the cost of living (and therefore buying property) has effectively doubled over the last few years. Now factor-in the fact that Thailand has been hit hard by the COVID pandemic economically, it has always been politically unstable and Thailand has recently seen a tightening of Visa restrictions.

You don’t need to be a rocket scientist to understand why there are a lot of discounted properties on the market locally. Expats in Thailand have seen the cost of living double over recent years simply because of the exchange rate. Add-in inflation and Thailand is not the attractive proposition it once was. A mass exodus of expats? Yes, it’s happening. And if the THB happens to weaken – any purchase now will prove highly premature.

It doesn’t matter if you are a young free and single millennial, a single, separated or divorced middle-aged person or someone setting out to enjoy your latter years – the vast majority of single (or supposedly single) expats can leave their brain on the tarmac once they arrive in another country to live. Affairs of the heart have frequently devastated expats and all too frequently have left them destitute, suicidal or at the very least bitter, unhappy and cynical.

For every beautiful story of romance, love and eternal happiness and fulfilment there are countless others of heartbreak, sadness and regret. It doesn’t matter what age you are, your demographic, socio-economic background or level of education.

Falling in love costs money! And falling in love abroad can cost you a lot more – especially for people who feel it necessary to convince themselves and others that “it’s different this time”, or “he/she’s not like that”.

In many countries as a foreigner you cannot own land outright. This should be the greatest cause for concern for expats in places like Asia e.g. Thailand and the Philippines. Sure you can often buy a condominium in your name (subject to allocation(s)) but houses? Nope!

This is where mistakes are made. Expats often circumvent local property restrictions by buying property in their local girlfriend/spouse’s name.

Would you ever logically buy anything if you could never own it? No!

Of course your delightful new partner/spouse will always extoll the virtues and benefits of doing so – because if the relationship breaks down (as so many do) they own the asset, not you. Say goodbye to that investment. Of course it won’t happen to you, right? Well, unfortunately if you truly believe this then you are a prime candidate to be one of the countless expats that it does happen to.

Don’t just think this happens to horny old men chasing young Asian girls. I have seen several otherwise sensible and intelligent women be suckered by ‘true love’ in the Mediterranean and Caribbean too.

If a property is not in your name – you don’t own it. You never have legally owned it, so stop thinking of it as an asset, or that you have any rights to it whatsoever. You can kiss goodbye to it and the “legal owner” should your relationship breakdown. Tough luck. You have been warned!

With a little knowledge and know-how there is no need to put up with poor T.V. abroad. It’s possible to stream all your favourite T.V. channels, movies and series online from anywhere. Let’s face it – foreign T.V. generally leaves a lot to be desired, and why miss out?

Even if you don’t watch a lot of T.V. usually, accessing movies online or having the ability to stream live channels for the kids (Disney, Nickelodeon, NatGeo, MTV etc.) can be a godsend. If you’re a sports fan, then being able to watch SkySports, Premier League Football, F1, Cricket, UFC, Darts and anything else you might be into can make your life abroad that little bit more palatable.

Recommended reading:

How to watch UK T.V. abroad

Every expat has their own dreams and ambitions. Settling-in takes time and you should not be tempted to rush things. Stay disciplined and do not allow yourself to make the same mistakes so many expats before you have made. Take the time to assess your budget beforehand, reassess your budget frequently and most important of all:

Stick to your budget!

Fail to plan – Plan to fail.

Save up to 60% using this link

Encrypt your data when online +

Start enjoying UK T.V. from abroad, including:

BBC iPlayer, ITV Hub, Netflix (UK) (USA) and more.